The cryptocurrency market’s volatility has shaped a global ecosystem that is both tumultuous and full of opportunity. Nowhere is this more apparent than in the daily swings of XRP, the digital asset at the heart of Ripple’s payment protocol. XRP remains one of the most watched tokens, not only because of its unique utility, but also due to a series of high-profile legal, technical, and market developments. Reliable, up-to-the-minute information—like that provided by platforms such as Coindesk—is paramount for both investors and analysts seeking to understand market nuances and anticipate trends.

The Role of Live Price Data in Crypto Decision-Making

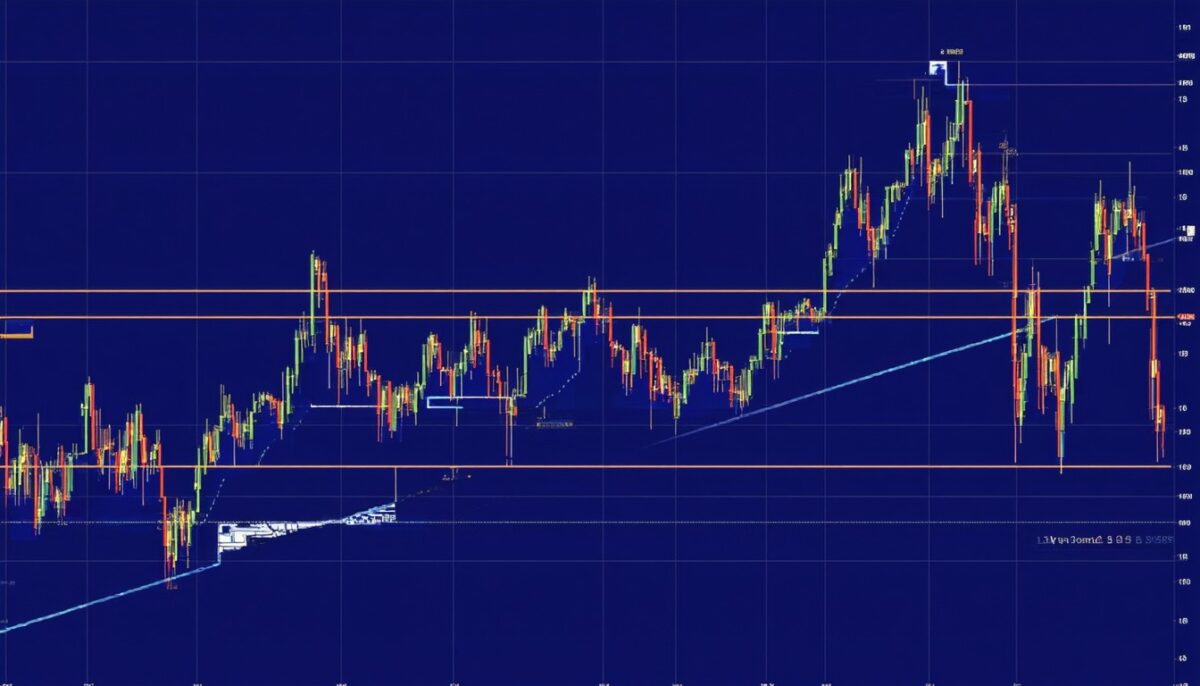

Access to real-time price data is a linchpin for anyone participating in the XRP market. Live pricing and charting, such as those provided by Coindesk, allows market participants to swiftly assess price movements, gauge sentiment, and respond to rapid market changes.

Why Live Charts Matter for XRP

- Immediate Market Reaction: XRP is especially prone to sharp moves driven by news events, including regulatory updates or payment adoption headlines.

- Technical Analysis Opportunities: Real-time charts make it easier for traders to spot patterns, support and resistance levels, and trading volume spikes.

- Investor Sentiment Tracking: Price feeds signal where the market’s mood is shifting, especially during turbulent times or major announcements.

Experts agree that, without accurate data feeds, crypto traders are effectively navigating in the dark.

“No market is more sensitive to both macro news and industry developments than crypto. Live price data isn’t just helpful—it’s essential for mitigating risk,”

says Adam Harris, a financial markets strategist.

Key Factors Driving the XRP Price Today

The price of XRP, as tracked on Coindesk and other market platforms, is influenced by a confluence of internal dynamics and broader industry catalysts.

Legal and Regulatory Context

Since December 2020, the SEC’s case against Ripple Labs has had an outsized impact on XRP prices. Updates from the lawsuit often trigger significant volatility. When the SEC’s suit against Ripple took a favorable turn in summer 2023, XRP surged on renewed investor confidence. Conversely, negative rulings or ongoing uncertainty tend to put downward pressure on the token.

Supply Management and Escrow

Ripple manages a substantial portion of XRP supply in escrow, releasing new tokens on a set schedule. How this supply enters the market—or remains locked away—has a direct effect on liquidity and, consequently, price dynamics.

Adoption Trends and Payment Network Growth

Unlike many crypto assets, XRP’s proposition is closely tied to its real-world use case: enabling fast, low-cost cross-border transactions. Any notable partnership with financial institutions, or real-world payment corridors going live, often coincides with price rallies.

Macroeconomic and Altcoin Correlations

XRP does not exist in a vacuum. Broader Bitcoin price moves, shifts in investor sentiment toward risk, and macroeconomic headlines (interest rates, inflation fears) ripple across the entire crypto landscape and frequently drive all major tokens in tandem.

How Coindesk Delivers XRP Price Analysis and News

Coindesk, recognized as one of the most influential crypto media outlets, offers a multifaceted approach to tracking and analyzing the XRP price.

Features of Coindesk’s XRP Price Coverage

- Live Interactive Charts: Real-time candles, volume, and historic performance on various timeframes.

- News Feed Integration: Price charts often sit alongside breaking headlines—critical when sudden price swings are news-driven.

- Expert Columns: Market analysts regularly weigh in with technical analysis, regulatory updates, and broader industry commentary.

Beyond the Chart: Context and Sentiment

One major value-add is the ability to contextualize raw price action with timely news. For instance, when XRP moved sharply in July 2023, Coindesk’s live chart was paired with in-depth coverage of Ripple’s partial legal victory, drawing the link between news and market moves for readers.

“Timely analysis—combining price action and headline context—helps investors separate noise from genuine market signals,”

notes Rachel Lin, a digital asset research lead.

Data Sources and Reliability

Coindesk aggregates prices from multiple exchanges to deliver a representative average, reducing outlier-induced volatility. This methodology ensures users are not unduly swayed by anomalies on any single platform.

XRP Price Patterns and Technical Analysis Frameworks

For many traders, decision-making hinges on technical analysis. XRP’s volatility and market structure lend themselves to several well-known trading frameworks.

Popular Technical Tools for XRP

- Moving Averages (such as the 50-day and 200-day): Used to spot trend changes and key support/resistance zones.

- Relative Strength Index (RSI): Flags overbought or oversold conditions—frequently tested in XRP’s rapid upswings and sell-offs.

- Fibonacci Retracements: Map likely reversal points after major price moves, often respected in XRP’s chart history.

Support/Resistance and Price Momentum

XRP tends to find strong support and resistance at psychologically significant levels (such as $0.50, $1.00, $1.50), and sharp price spikes are frequently contested as traders realize profits or reposition after news events.

Example: XRP’s 2023 Price Surge

In July 2023, legal developments pushed XRP from under $0.50 to above $0.80 within hours. The move broke longstanding resistance, and analysts who tracked volume and RSI identified the start of a fresh bullish impulse. On the other hand, subsequent pullbacks confirmed former resistance had turned into support—a pattern consistent with classic breakout theory.

News-Driven Volatility: Lessons from Recent XRP Events

Unlike less news-sensitive tokens, XRP’s price reliably reacts to major announcements. Regulatory headlines, payment partnerships, or rumors can move the market in minutes—not hours.

Case Study: The Ripple v. SEC Ruling

When the judge issued a split summary judgment in July 2023, XRP’s price doubled briefly, with trading volume surging on global exchanges. Coindesk’s immediate news alerts and price charts captured the chaos, underscoring the importance of melding live data and news analysis.

Persistent Legal Overhang

Despite positive momentum, ongoing appeals and final outcomes from the SEC case still weigh on sentiment. Many market participants now check platforms like Coindesk not just for price, but for legal updates shaping those numbers.

Strategic Considerations for XRP Traders and Investors

Given the unique mix of utility, regulatory attention, and high-profile partnerships surrounding XRP, market participants should approach it with a multi-dimensional strategy.

Risk Management is Key

- Monitor News Feeds: Stay alert for breaking information, especially legal updates.

- Use Stop-Loss Orders: Due to sharp volatility, protect downside with automated risk tools.

- Diversify Exposure: Don’t over-allocate to XRP exclusively; pair with other assets to balance risk.

The Value of Independent Data

Relying on platforms like Coindesk for live pricing and contextual news helps investors avoid echo chambers and develop a nuanced understanding of the market.

“A strong market thesis goes beyond price; it’s about stitching real-world trends, legal developments, and technical insights into a unified outlook,”

observes digital assets columnist Priya Singh.

Conclusion

XRP continues to be one of the most fascinating—and debated—cryptocurrencies in the market. The intersection of live price data, headline news, and evolving market analysis, as seen on Coindesk, is central for anyone seeking to make informed decisions. With legal, technical, and adoption factors all intertwining, only a holistic approach empowers traders and investors to respond with clarity and confidence. As the market evolves, staying plugged into reliable, multi-source platforms remains crucial for navigating both immediate volatility and longer-term trends.

FAQs

How can I view the live price of XRP on Coindesk?

Visit Coindesk’s website and access the Markets section. Their XRP page features a real-time price chart, historical data, and related news.

What factors move the price of XRP most?

Key drivers include regulatory actions (especially the Ripple-SEC lawsuit), new adoption partnerships, marketwide crypto trends, and Ripple’s escrow releases.

Why is XRP’s price so volatile after legal announcements?

Legal developments, particularly those involving the SEC, can lead to sharp changes in market sentiment. Traders and investors often react quickly, resulting in rapid price swings.

How does Coindesk calculate its XRP price average?

Coindesk aggregates data from multiple major exchanges to provide a representative spot price, smoothing out anomalies from individual platforms.

What are common technical indicators used for analyzing XRP?

Popular tools include moving averages, RSI, and Fibonacci retracements, as these help traders spot trends, identify entry or exit points, and understand overbought/oversold conditions.

Is XRP a good long-term investment?

Its long-term potential depends on both regulatory clarity and continued real-world adoption. As with all digital assets, investors should carefully research and manage risk before committing significant capital.